Price: £1.02

Market Cap: £119.1 million

Enterprise Value LTM: £134.7 million

Revenue LTM: £134.3 million

Net Income LTM: £10.2 million

Introduction

Investing in a compounder as a value investor seems like a difficult proposition. And that's almost by definition because you can't classify a compounder as such until it has built up capital over an extended period of time. But at that point, the valuation is often pretty stretched and far from being a value pick, and that means forward-looking returns often don't look that great, even if the company continues to be successful over the next few years. I think Supreme is a rare exception here, as I see it as a (future) compounder at a depressed price. To me, this is the ideal starting point, as I feel the market is underestimating not only the near-term earnings potential of the company, but also the likelihood that it can generate very high returns on invested capital in the future. This could lead not only to an increase in valuation in line with a strong business performance, but also to a strong expansion of the multiple as several quality investors could choose Supreme as their compounder pick. As always, this is just my reasoning for investing in the company and not investment advice!

My investment thesis is threefold: Currently, investors are underestimating the company's earnings potential, which should lead to a reasonable rerate in the short term. Medium-term, the vaping sector continues its strong growth for the foreseeable future and Supreme maintains or improves its market position. Long-term, the management continues its excellent capital allocation and takes advantage of opportunities when they see them.

I will start by introducing Supreme's business, but will then focus on the segment that I believe is currently the most exciting for the company's future, the vaping segment.

Business description

Supreme PLC is an AIM-quoted UK company that has become a leading distributor in the fast-moving consumer goods (FMCG) sector. With a strong presence in the UK, Supreme PLC has earned a reputation for its expertise in supplying a wide range of FMCG products to retailers, wholesalers and consumers.

Supreme PLC has successfully navigated the dynamic FMCG landscape for several decades, since the company was founded in 1975 by the father of the current CEO. The company's extensive experience and deep understanding of consumer trends and market dynamics have made it a trusted partner for global brands.

Supreme PLC's portfolio covers a wide range of FMCG products, including batteries, nutritional supplements, lighting products and vaping products. By working with renowned brands and suppliers, but more importpantly by continuously adding and improving their own brands, the company ensures that its customers have access to a comprehensive range of high-quality products that meet the changing needs of consumers.

What sets Supreme PLC apart is its robust distribution network that spans the country and reaches every corner of the market. This is the foundation of the company, which its CEO and majority shareholder Sandy Chadha steers with what appears to be an excellent operational and strategic allocation of capital. Two years after taking over the company in its entirety from his father in 2003, he used IT investments to set up a completely paperless warehouse and office, as well as an online ordering system (in 2005!).

While Supreme PLC was not much more than a truck from which Sandy Chadha's father sold toys and watches for the first decade and a half, its entry into the battery business laid the foundation for today's Supreme. Supreme entered the battery market in 1991 "after stumbling upon samples at a trade show. Operating from a 3000sq/ft warehouse, we sign distribution agreements with Panasonic and achieve annual sales of £2.2 million." Today, the battery business has a 20% market share in the UK, and Supreme supplies batteries to over 50,000 retailers, wholesalers and independent outlets, resulting in the fantastic distribution network mentioned above.

While the foundation of the company has been laid with the battery business, looking ahead I am much more excited about the opportunities in the health & wellness and especially the vaping space.

Return on capital from FY18 to FY22 was in a phenomenal range of 33.3% to 54.9%, which supports my argument of excellent capital allocation. To illustrate this, here are two capital allocation decisions made by management: In 2018, Supreme acquired the assets of Irish sports nutrition company Shannon Protein Technologies for £100,000. The purchase of this production machinery laid the foundation for a new business segment that generated nearly £16 million in revenue in FY22. The second example is more recent. In August 2022, Supreme purchased the assets of Cuts Ice Limited and Flavour Core Limited for approximately £2.6 million (value of intangible assets alone: £1.4 million), which included vaping contract manufacturing and proprietary brands. In March 2023, Supreme sold just the intellectual property of T-Juice (the strongest brand in the acquired portfolio) for 4.5 million euros.

Vaping segment

While the health & wellness segment is also very promising regarding future revenue and earnings potential, and there is no meaningful doubt about the other segments being cash cows for the foreseeable future, I would like to concentrate on the vaping segment as this segment was accountable for nearly 70% of gross profit during LTM (company will report on July 5th and I expect this figure increased during H2 2023).

If you are from the UK you are probably well aware of the brand 88vape as you will find their displays in retailers all over the country. If you are not from the UK, like myself, I can tell you that Supreme states a market share of 33% for their vaping products, a majority thereof is the flagship brand 88vape. It is important to note that this is the share of the market volume and not the market revenue as 88vape is priced for the best value for money on the market. I like this strategy a lot as it supports continuing growth of their market share, should create a very nice resilience or even an opportunity in a possible recession as consumers would maybe trade down to 88vape and leaves a lot of room for possible price increases in the future. Besides 88vape Supreme offers also premium products among others under their own KiK brand or the recently acquired Liberty Flights brand.

Supremes endeavor in the vaping market started at the end of 2012 with the launch of KiK. At the same time the company started their own E-liquid manufacturing in their Trafford Park, Manchester premises. Todays flagship brand 88vape was launched in 2015 and gained market share since then by delivering good quality at an unbeatable price point. The liquids of the company are sold to the end consumer for £1 each. This is for a product not only developed but also manufactured in the UK. Despite this low price point and recently a strong shift in the revenue mix due to an ever increasing popularity of lower margin disposables, the vaping segment achieved a gross margin of around 38% during the first half of the financial year 2023 (ending September 2022). Combined with a very lean organization this is more than sufficient for a very nice profitability. The processes should be even more efficient in the future as the company is currently in the process to consolidate six warehouse operations at a new warehouse just a few hundred meters away from the headquarters. This should not only lead to more efficient logistic processes, as the company had to facilitate several different warehouses they added because of their strong growth, but also offers a lot of capacity for growth. And the company does not even have to pay rent overlap as the new facility is rent free for 12 months. The company is currently in the relocation process and expects to continue normal operations on 3rd of July.

I believe the vaping segment has a lot of runway in the UK but I am sure the company has also a possibility of being successful in penetrating the continental European market. In fact, the company already stated during the last earnings call the desire to expand in major European vaping markets like Germany and France. Today we know a little bit more what this expansion could look like, as the company entered in an interesting cooperation with the buyer in the already mentioned T-Juice transaction. With the sale of the T-Juice IP Supreme entered simultaneously into a partnership with LVP (buyer), secured exclusive manufacturing rights for the T-Juice brand for five years and more importantly: “A strategic partnership with LVP provides future cross-sell opportunities for the wider Supreme portfolio.” The strategic partnership could enable Supreme to expand relatively risk free into the European mainland where LVP is active.

Vaping market in the UK

According to an Action on Smoking and Health report (ASH report), 8.3% of the adult population in the United Kingdom are vaping (as of August 2022). That's 4.3 million people and an increase from 800,000 ten years ago. "As in previous years, the main reason ex-smokers give for vaping is to help them quit smoking (29%). The next most common reasons are to prevent relapse (19%), to enjoy smoking (14%), and to save money (11%).” According to the report, by 2022, 57% of vapers are ex-smokers, 35% are current smokers, and 8% have never smoked. The numbers clearly show that growth in the vaping sector is currently coming from the pool of regular smokers. However, the proportion of never smokers was higher than ever in 2022, suggesting that the growth of the market is not limited by the pool of smokers.

According to the UK government, 6.6 million people smoked in 2021, which is the lowest number since 2011. One of the reasons for this is certainly the 29% of today's vapers who used to smoke. In fact, the UK government supports vaping as a way to reduce the number of smokers in the country. The NHS calls e-cigarettes "a very popular aid to smoking cessation in the UK." The government has even introduced what it calls the "Swap to Stop" program, which aims to provide one million smokers with free vapor starter kits.

Negative discussions about vaping revolve around concerns about children starting to vape and the environmentally harmful disposable products. The UK government is understandably cracking down on the illegal sale of nicotine products to minors and retailers giving free samples to children, which appears to have been a loophole in the UK. In addition, the government is considering a complete ban on vaping products for children, including nicotine-free products.

In my opinion, these are all very understandable measures, but they shouldn't really affect Supremes' business. In fact, a ban on disposables would probably even be positive for Supreme, as they are lower margin products and users of disposables would likely simply switch to regular refillable vaping solutions.

The market size of the UK vaping sector was £1.325 billion in 2021 and is expected to grow at a low double-digit rate in the coming years. The market size compared to Supremes vaping sales (approximately £75 million in FY 2023) not only shows great further potential in this category, but also highlights the extreme value proposition of Supremes products, as their market share in terms of sales is much smaller than the volume they bring to market. Even if I were a big tobacco company, I wouldn't want to be a competitor to Supreme in this market.

And perhaps this is even an additional aspect of this investment: in March 2023, Altria announced the acquisition of NJOY, a U.S. vaping company. According to the latest available revenue estimates, NJOY generated similar revenue to Supreme in the vaping sector. I'm not suggesting Supreme could get a similar multiple for its vaping segment, as the U.S. market has much greater potential than the U.K. and NJOY appeared to have the only FDA-approved device. But Altria paid $2.35 billion for NJOY, and Supreme's market cap today is about £120 million. I don't know if any tobacco company is interested in Supreme's vaping assets or if Sandy Chadha would consider selling, but if so, I would guess that the segment would be worth many times the market cap of the entire company today.

Valuation and why I think this opportunity exists

In two words, Covid and inflationary pressures. During the Covid period, retailers in the UK severely overstocked their lighting products. This resulted in lower sales growth for Supreme compared to previous years and lower profitability, as costs in this segment are largely fixed due to the nature of the business and operating leverage works both ways. The company said in its last conference call that it sees improvements in this segment and expects to return to pre-crisis sales in the near future.

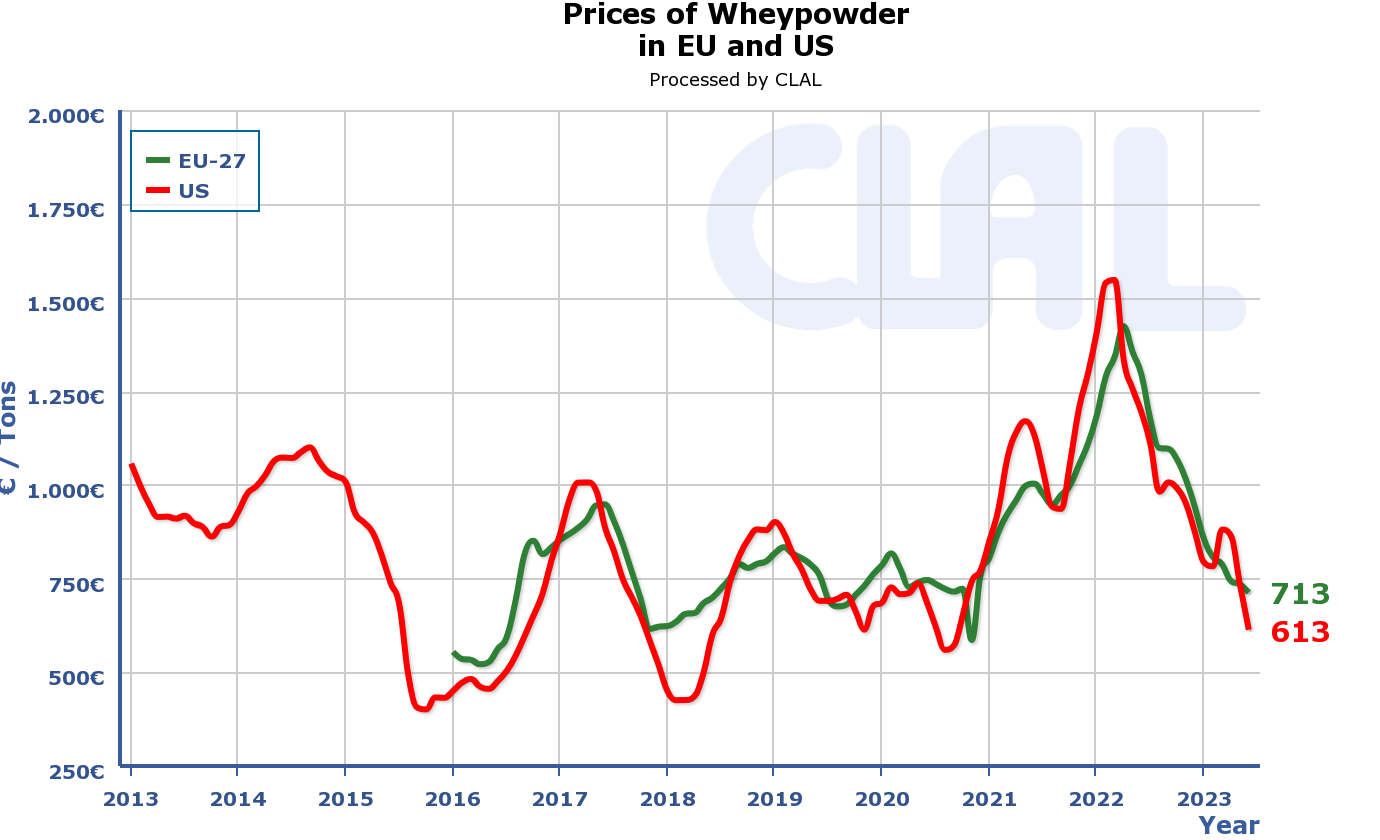

The health & wellness business was particularly affected by rising input costs, as the main raw material for the product line is whey concentrate. Unfortunately, I have only found data from the EU-27 and the US (which look very similar), but at least the trend in the EU should be a good indicator of prices in the UK.

Whey powder prices rose sharply from the beginning of 2021, peaking at €1,432/ton in April 2022 and since then falling again to €713/ton in June 2023. As a result of these increases, gross profit in the health & wellness segment fell to 18% in the first half of fiscal 2023 (April to September 2022). The average price for whey powder (EU) during this reporting period was €1240/ton. The average price for whey powder (EU) in the reporting period ending March 2023 decreased to €911/ton. We will receive the report on July 5th and I expect a significant improvement in gross profit in this segment. There have also been some very prudent price increases which, together with raw material prices continuing to stabilize since March (average €730/ton), should lead to a return to previous profitability in this segment.

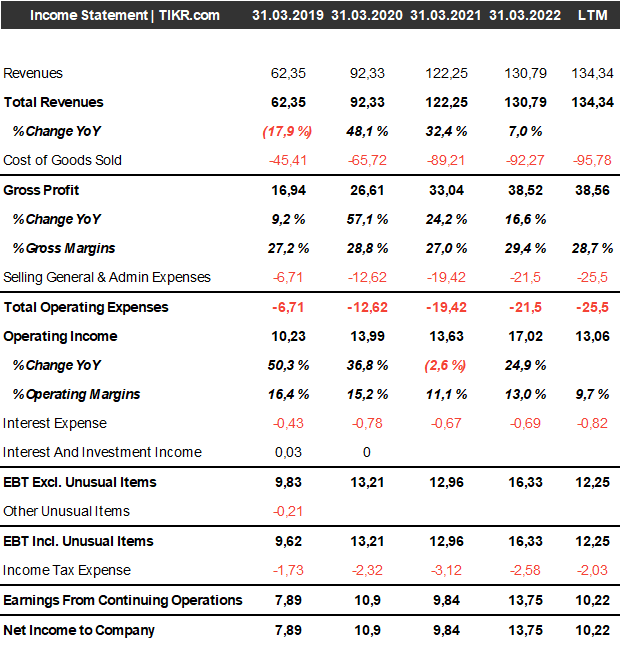

Looking at the company's figures without this knowledge, Supreme does not look like a totally exciting growth story. Sales were only just slightly up in the LTM figures compared to the full year 2022 figures, and net profit was down by more than £3.5 million, which on the surface suggests an end to the growth story, as sales in FY2022 were also only up 7% year-on-year, and furthermore margins now also appear to be under pressure, with net profit down significantly despite a small increase in sales.

Also, the company didn't go public until 2021 and is a microcap, albeit a pretty big one compared to my usual portfolio positions. So I suspect not many investors know the story and not many are excited about the stock's performance, as it went public at 50% above today's price.

I think we're at a very interesting point for Supreme, as the growth and earnings potential of the vaping segment becomes more apparent, and at the same time, the lighting and health & wellness segment are getting back to old performances.

In terms of valuation, Supreme is trading at a market cap of around £120 million, and the company stated that it was net debt free as of the end of March 2023, so the market cap is equal to the enterprise value. So even based on the depressed LTM numbers, the company is trading below a P/E of 12 (by the way, net income converts very well to FCF). We'll get the detailed numbers on July 5th, but the company has already announced in its year-end trading update that it generated revenue of £150 million and adjusted EBITDA of at least £19.3 million, which should put it very close to FY2022 profitability despite the poor first half.

So let's just assume that Supreme ends FY 2023 with a net profit of £12.0 million. That means Supreme is currently trading at a P/E of 10, and that's for a company that has grown sales by almost 15% in a difficult year, has great assets in a growing market with government support, recovering business segments with the health & wellness segment itself showing great promise, and an excellent capital allocation philosophy embedded in a great M&A strategy. This business has generated a return on capital of 33.3% to 54.9% over the period between FY 2018 and FY 2022. I won't say here what I think this business is worth, but I am very confident that today's price is not the right price.

Disclaimer: The sole purpose of this report is to explain the rational behind the investment I made on my own behalf. This report reflects an opinion and is for informational and entertainment purposes only. It is not intended as investment advice. It may contain errors, and I may change my opinion expressed in this report at any time. You should always do your own due diligence and never blindly follow anyone in an investment. I as well as members of my family hold this stock in personal accounts.

Unfortunately, due to the limited investing universe at wikifolio, it is not part of the portfolio of the wikifolio FinancialSkeptic Value, which I manage and which is mirrored by an investable (probably only for Germans, Austrians and Swiss) certificate. You can find more information about my Wikifolio with this link (German).

This company continues to deliver. Yesterday Supreme released two RNSs. The first outlined a series of proactive measures to curb the rise in underage vaping and reduce the environmental impact of disposable vapes, and the second was a trading update.

I think it is very wise to be proactive in light of the ongoing discussions in the UK about the increase in underage vaping, and it is completely consistent with previous statements made by the CEO. I continue to believe that all of the bad sentiment surrounding this company due to discussions about single-use vapes and vaping by children is total bullshit (because I believe that measures will not have a negative impact on Supreme in the long term).

The trading update shows that management is indeed very conservative, and in the linked interview the CEO even says that this is the case and that they want to hit the numbers even if there are unforeseen hiccups along the way. They announced H1 revenues of at least £100m, which is already higher than my conservative estimates in my last post.

vaping category update: https://polaris.brighterir.com/public/supreme_imports/news/rns/story/w3j77jx

trading update: https://polaris.brighterir.com/public/supreme_imports/news/rns/story/rnonnjw

CEO interview: This company continues to deliver. Today Supreme released two RNSs. The first outlined a series of proactive measures to curb the rise in underage vaping and reduce the environmental impact of disposable vapes, and the second was a trading update.

I think it is very wise to be proactive in light of the ongoing discussions in the UK about the increase in underage vaping, and it is completely consistent with previous statements made by the CEO. I continue to believe that all of the bad sentiment surrounding this company due to discussions about single-use vapes and vaping by children is total bullshit (because I believe that measures will not have a negative impact on Supreme in the long term).

The trading update shows that management is indeed very conservative, and in the linked interview the CEO even says that this is the case and that they want to hit the numbers even if there are unforeseen hiccups along the way. They announced H1 revenues of at least £100m, which is already higher than my conservative estimates in my last post.

vaping category update: https://polaris.brighterir.com/public/supreme_imports/news/rns/story/w3j77jx

trading update: https://polaris.brighterir.com/public/supreme_imports/news/rns/story/rnonnjw

CEO interview: https://www.youtube.com/watch?v=175Te0qSR6k

My 2 cents on the current share price development. No investment advice, do your own due diligence! The price drop in the last few days and especially today is completely irrational in my opinion. People seem to think that the worst case scenario is happening, which in my opinion is simply not the case. The sentiment around the company and its stock has long been driven by fears of a disposables ban in the UK. I think it's coming, but I don't think it's a worst-case scenario. Supreme made about £12 million from disposables last year. That's not even 16% of the vaping revenue, and the profit margin is much lower than the other vaping products. Would it be nice to have the disposables business? Of course, but it's not the driving force behind the company's success so far, and I expect Supreme to be successful without disposable products. Many people will switch to refillable or pod solutions, which Supreme already offers. By the way, disposable products are made in Asia, and the company doesn't have full control over them. I could even imagine that a ban on disposable products will be positive for Supreme in the long run.